If you've never heard of Synchrony Bank, but seen it advertised everywhere online, you wouldn't be alone.

In fact, if you looked prior to 2014, you wouldn't have seen Synchrony Bank anywhere. Then, in what appears to be an instant, it was everywhere.

That's because Synchrony Bank was founded in 2003 but operated as a subsidiary of GE Capital. It's now a retail bank but they don't discuss their history much. It would IPO in 2014 on the NYSE with the ticker SYF to the tune of $2.88 billion. It didn't appear out of nowhere unless you consider an IPO “out of nowhere.”

(does this story sound familiar? Ally Bank was once General Motors Acceptance Corporation, GM's financial services arm, and these stories rhyme)

So who is Synchrony Bank?

About Synchrony Financial

They're a financial services company based out of Stamford, CT and they offer everything you'd expect from a bank – deposit, credit, financing, and lending. In layman's terms, that's checking and savings accounts, credit cards, mortgage, car loans, and the like. They also provide private label credit cards (they're one of the biggest), so they are the backbone behind some popular retailer credit cards like Amazon, Lowes, Walmart, and Gap.

Synchrony Financial is the parent company, Synchrony Bank is the institution that provides those products. They're FDIC insured #27314 and they're headquartered in Utah.

Synchrony Financial (SYF) had revenues of $13.530 billion in 2016 and is a component of the S&P500 index.

Synchrony Bank has just one physical branch in Bridgewater, New Jersey – 200 Crossing Blvd, Suite 101, Bridgewater, NJ 08807. Branch is open Monday – Friday from 8am to 3pm EST.

You can contact Synchrony Bank customer service by calling 1-866-226-5638 (Monday – Friday 8am-10pm EST, Saturday 8am-5pm EST, Closed Sunday). The Synchrony Bank login is here.

Synchrony Bank's routing number is 021213591.

Synchrony Bank Deposit Products

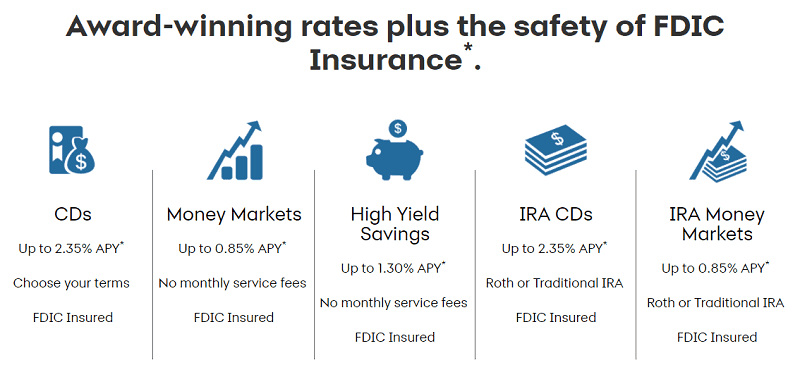

Synchrony Bank offers the full menu of deposit products – money market (similar to checking), savings, high yield savings, certificates of deposit, and even IRA accounts.

All rates cited are as of 4/3/2023:

- High-Yield Savings: No monthly service fees, 4.75% APY, no minimum balance.

- Certificates of Deposit: Maturity periods of 3-months to 60-months, $2,000 minimum deposit and the 12-month CD yields 4.50% APY

- Money Markets: No monthly service fee, mobile check deposit, no minimum balance, up to 2.25% APY

- IRA: You can open a regular IRA account or an IRA CD account.

Synchrony Bank Credit Card

Synchrony Bank's credit card, called the Synchrony HOME Credit Card, is a no annual fee credit card that is a card for home purchases that offers promotional financing of 12 months to 60 months at participating retailers. They are mostly home furnishing or home improvement stores. It also offers 2% cash back on purchases under $299, paid as a statement credit.

Synchrony Bank also issues several white-label credit cards, meaning they're run by Synchrony Bank but they are branded with others names. One popular Synchrony Bank powered credit card is Amazon.com's Amazon Prime Store Card – which gives you a $10 Amazon.com gift card upon approval plus 5% cashback at Amazon.com with no caps. No annual fee, special financing on orders $149 or more, and all the typical protections of credit cards, like $0 liability.

They also power other retail cards like American Eagle Outfitters, Athleta, Chevron, Old Navy, PayPal & eBay, Sam's Club, Toys “R” Us, Walmart and more. If you have one of those cards, you may have seen SYNCB appear on your credit report. I had SYNCB/PPC and was surprised to see it because I didn't know it stood for Synchrony Bank / PayPal Credit! It's normal though, just looks weird.

Synchrony Bank Fees & Penalties

Like many online banks, there are no minimum balances for their savings or money market accounts. There is also no monthly service fees.

What is rare is that they will not charge you a fee if you exceed six withdrawals/transfers in a statement cycle. Many banks will charge this because you aren't supposed to (according to the Federal Reserve) treat a savings account like a checking account, but Synchrony won't. They do, like other banks, reserve the right to close your account if it happens too much.

With their CDs, there is an early termination fee if you make a withdrawal from your Cd before the maturity date:

- Term 12 months or less: 90 days of simple interest at the current rate

- Terms of more than 12 months but less than 48 months: 180 days of simple interest at the current rate

- Terms of 48 months or more: 365 days of simple interest at the current rate

These interest penalties are fairly standard – it's the exact same as what Bank of America and any major bank would charge.

The gold standard of CD rate penalties is Ally Bank:

- Term 24 months or less: 60 days of simple interest at the current rate

- Terms of more than 24 months but less than 36 months: 90 days of simple interest at the current rate

- Terms of more than 36 months but less than 48 months: 120 days of simple interest at the current rate

- Terms of 48 months or more: 150 days of simple interest at the current rate

It's almost unfair to compare the penalties with Ally Bank because they are far and away the lowest for early withdrawal.

Loyalty Perks

Synchrony Bank also offers “Loyalty Perks” that reward you for saving.

Whereas most institutions, like credit cards, will reward you for spending – Synchrony rewards you for saving.

The Perks Tiers are based on your balance and time with Synchrony:

- Basic: Balance under $10,000 AND less than 1 year

- Silver: Balance of $10,000 – $49,999.99 AND 1+ years

- Gold: Balance of $50,000 – $99,999.99 AND 2+ years

- Platinum: Balance of $100,000 – $249,999.99 OR 3+ years

- Diamond: Balance of $250,000+ OR 5+ years

Sadly, Synchrony Bank does not have any new account bonuses right now.

Pros and Cons

The main pros are similar with other online banks – you get low/no fees, a wide ATM network due to partnerships, debit cards, much higher interest rates, and the smartphone apps are more powerful. They offer free checks for the money market account and there is $5 in ATM reimbursements. The Loyalty Perks are a nice add-on we don't see elsewhere

The cons are similar too – there no branches you can visit and everything happens via the app (or perhaps mail) or online. You have to be comfortable with working with a bank entirely online if you want to go with Synchrony Bank. I personally have no issue but if you're not comfortable, Synchrony Bank would not be a good option for you.

Conclusion

Synchrony Bank is fine but doesn't really excite me in any way.

I don't ever suggest rate chasing, switching banks for the best rates, but if you're #1 bank is an old brick and mortar bank with abysmal interest rates… it's worth a look at this high-yield savings account.

Miguel (The Rich Miser) says

Hey Jim! I’m a huge believer in online banks; switched about 5 years ago and never looked back. The only reason I can think of to have a brick-and-mortar bank is if you need to frequently do large cash deposits and withdrawals (and in that case I would probably use a credit union).

I still see a lot of people, though, that like to personally know the people that work at a bank, and are very reluctant to switch to online banking because of that. But I’d say that’s costing them money.

Cash transactions (and how rare are those!) are one of the few reasons to have a brick and mortar bank account… maybe also medallion guarantees (even rarer!).

Lily @ The Frugal Gene says

We have the Amazon store card which is by Synchrony. I didnt know they offered a high interest rate at 1.30% (with no minimums.) My husband went with Discover at 1.10% because it was the easiest (no upkeep, no minimum etc.) but I think we should have shopped around some more.

Jimmy says

Haha are these real replys above me? Synchony bank is a joke, i currently have three different credit accounts and all are over 25%. I had to take out a loan from my current good bank SECU to pay the one care credit account I have through them. Making more than minimum payments don’t help. Will never recommend them to anyone.

You’re talking about credit, this was more of a review of their deposit products. Your interest rate will be a function of your credit score as well as other debt related factors. If you feel it’s too high, I’d recommend trying to find a balance transfer to a lower rate card.

Lidia says

Syn-crappy Bank is a joke.

It price gouges the public on basic credit cards for staters and does not pay that much on CD’s or savings.

So why would anyone recommend them unless they work for them?

I just cancelled 2 credit cards with them for TJ Maxx, & Amazon because they price gouged me by tacking on an EXTRA $27.00 late fee for one month. Now I only have 2 credit cards, and only because they offer (I thought), good perks, but this past month Syn-Crap took liberties and charged me an extra $54.00 in total for me not receiving ‘THEIR’ bill………!!!!!!!!!! You see I always pay my bills in full every month but something happened to our mail this past month and Syn-Crap did not hesitate to charge for this. They blamed my extra charges on their billing machines which are on autopilot. Bull crap.

Also and lastly, I have cancelled my TJ Maxx card and am strongly thinking about cancelling my Amazon card. They have taken advantage of the corona virus to overcharge customers and I hate companies like this even if I do get 5% back on purchases.

Hidden For Protection says

I always get the bill in the mail for my loan 4 days before the due date. I send it out the next day – 3 days before the due date. I figure it takes the Post Office 2 days to deliver it (maybe 3). Synchrony Bank apparently takes a day or two to get it through their “system”. So every month my payment is marked as “Late”. They “can’t mail [my] bill out sooner”, and suggest automatic deduction. You can’t pay online (it is the ONLY loan I have that I can’t pay online!). You can’t even set up automatic deduction online, you have to request it, and then they MAIL you a form. In 2018! No, this review is NOT from 1998. People have told me it’s their scam to always charge a late fee.

That’s incredible… no online billpay???

Mike Wolff says

I have used Synchrony to finance a project. NEVER AGAIN! The interest rate jumped up to 29.99 % after the promo period, which is understandable – I agreed to that. I got hit with deferred interest – I slipped. My fault. However, after over 3 years of faithfully paying my bill, they still refuse to lower my rate. I repeat, NEVER AGAIN. I will pay these leeches off, and if I ever have another customer that wants to finance with them, I’ll walk away.

Rachel moyer says

I agree that your post has to do with banking and not credit. However, the company name Synchrony is much more identified with their credit cards. And with that, they are an awful company to work with. I have had credit card companies that have switched and now I shudder when I hear their name. When applying for credit and hear their name, I cancel my request and seek another lender. There are so many customer service and credit companies that deal with all types of consumers, it’s worth shopping around. We deserve better.

Kuortne says

My experience with Synchrony bank is hassle free.I recently got a credit card from Walmart which is financed by Synchrony bank and on the very first statement I observed an error.I pointed this out to customer service an the error was corrected without delay. Another positive experience was with my third statement where a supplier/merchant attempted to bill me monthly without my permission.Again ,a call to customer service corrected this issue. Please note that my card payments are done online since I set up an account to transfer my credit payments.

JACook says

Our 19-year-old daughter had her Chevron card declined last week, because she made the mistake of using her card near home, while we were traveling out of state. Apparently, that constitutes ‘suspicious activity’ to Synchrony Bank.

This is very troubling, because a Chevron card is not like most others, in that with most other cards, declining the card won’t leave you stranded, possibly in the middle of nowhere. Declining a card like Chevron can have some very real personal safety consequences.

We have never had issues with our Chevron cards since 1980, but after our experience dealing with the idiots at Synchrony, who were completely unresponsive to our concerns, we concluded that we cannot depend on the cards any more, so they have been cut up. I will NEVER accept ANY card backed by Synchrony Bank, now, or at any time in the future.

Isn’t that the fault of Chevron?

Pablo Philbrook says

I don’t think it’s a problem with Chevron at all; in fact your flip reply indicates that you are receiving a kick-backs from Synchrony.

To be more specific, before allowing a Chevron branded Synchrony C.C, an inquiry/permission request in made to the issuing financial institution. Synchrony, without bothering to check, decided that the daughter, who has a family type card, was not in the area of the primary account owners, could be a card thief, and declined her purchase which in fact could have stranded her in a rest stop somewhere (or worse). As Synchrony, in the world of cell phones, did not make an effort to contact the Primary or the Daughter and confirm, they are in fact to blame. The cardholders should consider obtaining another actual Chevron family account, which will be honored everywhere. Gas cards are not declined unless there is actual cause, not automated suspicion. This is, in fact, why people apply for specific branded gas cards, to avoid being stranded.

Nancy says

They also manage BP cards and I have had similar issues. I have had a BP card since 1984 when it was Amoco. I closed it today because the idiots at Synchrony cannot figure out when it’s me and when it’s not. Their loss. Unbelievable!

Arlyn says

I’ve been a Synchrony customer since GE Capital. I own both credit and deposit accounts , no issues , no worries.

Credit cards are deeply affected by Federal Reserve actions and of late it’s not a borrowers market however I pay off at the end of each month, still no worries.

Synchrony is easy to deal with and that’s it plain and simple. Rates are great and services are available online 24/7 so what’s not to like?

I can highly recommend Synchrony Bank.

john trautt says

I got a syncrony card through amazon. I opted for online billing. The first time I logged in they locked my account for suspicious activity and told me to call their office number. I called the office and they said a pin would arrive in a few days to unlock my account. The pin arrived 3 weeks later and when I called it in I was told it was an invalid pin and my account would remain locked. Unable to pay online (account locked) I called syncrony and asked for a paper bill, no bill came, but I got a lovely past due email with a late charge plus interest. 2 months and 8-10 phone calls I finally got a paper bill. I paid what I owed minus the late fees and interest and closed the account. Fast forward six months and I now get letters from a collection agency wanting 184 dollars in late fees + interest. gotta love banking efficiency. I have written 2 letter and talked to the offices over 20 times with no resolution to the problem, so not I just use their collection agency letters to light the fireplace.

Natalie Thomas says

Okay….Are you aware Sr. that Synchrony Bank offers their customers 100% fraud protection on the cards they service? They have thunders if not thousands of frodulent charges they have to staff people to investigate and charges they have to eat and they do eat them. I think with that kind of protection they give you a short hold up to place a call to tSynchrony in order to verify the validity of the suspicious charge isn’t as big a deal than itt would be if you were left without that fraud protection and held liable for the fraudulent charges. Those fraud holds are in place to protect you and your account from fraud. Also Not sure if your aware that before you travel with your card you should always call your banks to provide your travel plans which eliviates the problem of Bing stranded with a declines card. In addition all you need to do when your card declines over a suspicious transaction , you simply call the number on your card , verify the charge was yours and tSynchrony ‘m will imedeiatly remove the hold on your acct.

Anjanette Craynock says

Terrible customer service, complete with flippant attitudes due to highly restrictive policies and antiquated methods (i.e requiring you to fax or mail documents), rude managers, long transfer times into and out of the accounts. Save yourself the frustration and never do business with this bank; it’s not worth the man hours it will take you to get anything resolved should you ever have an issue and in the meantime, they will simply deny you access your money for weeks or longer.

Gary Woolery says

I am forced to use Synchrony because Sam’s Club uses it. I’ve been with Sam’s Club since 1996. I’ve had a few other credit cards companies that Sam’s Club used. Synchrony is beyond a doubt the worst in customer service. They have devised a way to withhold you rebate money that works for their benefit. I truly believe, because of this they are not a solvent bank, and should not be trusted with anyone’s money.

Janita says

I opened a account with this company to furniture 1 year ago with no interest if I paid the loan off in one year. Jan 2019 made a year and I had a bal 500. This company recalculated the interest what I would have paid add addition 400d to the balance plus charging interest monthly on top of the interest. This is double dipping.

Greg Dixon says

Have any of you ever seen Synchrony’s Better Business Bureau’s rating? It is absolutely abysmal as Synchrony has one of the lowest ratings ever posted to the BBB site. Why, because Synchrony is a predatory lender and is making billions off erroneous fees and charges only because the GOP has relaxed banking regulations so much that it is now legal for them to prey on consumers and squeeze the life out of middle class and poor Americans. Doubt me? Go to the BBB site….Synchrony’s rating is horrific.

Rick says

went to bbb site, says synchrony banks at my location are A+

can you provide link?

Lena Beigh says

As far as I am concerned, Synchrony could go belly up and the country would be better off. Lousy customer service, extremely pushy and rude people, employee people from outside the US who cannot understand or speak English let alone understand the product, and charge customers anything they can to make a buck. Will not work with anyone for anything at all. This is a junk company with a rating so low it is barely visible.

If you call and get a person overseas who does not understand or speak English, ask to be transferred to someone in the United States. They have to comply and it may take a few minutes for the transfer, but it is well worth the wait to speak to someone at least reasonably intelligent.

Kathy Wolverton says

I completely agree. I could not understand the customer service representative I got. Customer service should only be for anyone who has a good command of the English language. Therefore, instead of pawning this position off on people who are at entry level training, rather, pay the salary at a higher pay grade and hire good communicators and make your customers appreciate you. Isn’t that why you are in business? Get a clue!!!

Cathy G. says

I closed my JC Penney account through Synchrony because after trying to buy a gift card online, they flagged my account. After that, they insisted that they had to send me a one-time passcode by mail, so I decided to stop using the card instead of playing their stupid spy game. Then they cancelled the payment to my insurance that had been billed to the card for years and I lost the insurance. Now another of my cards through Synchrony is starting the same stupidity. I will never open another account with them, no matter how much I want the card or offer.

Becky says

After 12 years of being a customer of Synchrony, I got a letter in the mail saying that my account was closed. Just closed. So I called to see if it was some kind of joke. Nope, they closed my account. I paid my account every month and sometimes twice a month with I had the extra cash but that was not good enough for them. They are just heartless.

Dawn Roberts says

Been on hold 40 minutes my account was closed. It was paid in full repeatedly. The one before it was closed because it was never used and they gave some bs to my credit bureaus that my balances are too high and I have a delinquency of 30 days in which a payment was lost on another card not even synchrony acct. I always pay over the minimum. Paying my balances and I’ll close my own accounts. Done with this place.

Roy says

I recently realized Synchrony handles Pay Pal credit….. what a big mess Pay Pal is now! I buy a LOT of STUFF on eBay…… I always received an email confirmation that payment was made thru Pay Pal the SAME time I made the purchase. Not anymore, I have to log into my P P acct to see if vendor was paid. BRING BACK THE OLD PAY PAL CREDIT! I always made my payments to PP by phone for last 3 yrs – They changed that system too (not for the better)!

Tom says

I am a long time PayPal user since 2004. Synchrony has been a mess for me with my eBay transactions.

Robert says

I have an Amazon Store card service by these jokers. Opened account last year with $500. 00 opening credit. 8 months later for reasons they have chosen to take without informing me of why? They reduced the credit limit to $100.00 and I was not even in default?? Paid balances on time. They also Service Lowes and Closed that one without giving a legit reason. I recommend if any credit card serviced by Synchrony bank is listed DO NOT that is DO NOT apply. You will regret it if you make that mistake. They’re not worth it, PERIOD.

S Thomas says

My daughter passed and had an account with them. I, as her mother, closed out all of her finances, but didn’t know about Synchrony online banking. Five years later, they tracked me down as her executor and paid the balance to me. I didn’t even know she had a savings with them. That was my experience with them, so I’m using them for my CD’s. Honest bank.

Thomas says

Synchrony Bank #synchronybank takes forever to post payments to your card. I use it linked to my PayPal card. Employee Kierra6645 spoke with CS then employee above today and told me it was normal c.c. processing time frame. No it isn’t.

Thomas says

Have long time PayPal account with PayPal CC through Synchrony. There is an extensive delay when you transfer funds available to synchrony PayPal inside the PayPal account. Hope you have plenty of time to wait for posting. Apparently it is normal Kierra6645

Ed G. says

I was a customer for 10 days with a PayPal credit account while trying to make a payment on my account they would not take a payment with a credit card or savings. I have always made payments to my creditors using credit cards or my savings account. I have Learned just now that Synchrony banks do not honor these types of payments. I would advise those that are in charge that they need to post this on their websites. This in my opinion is a poor way of doing business although they offer savings account and issue credit cards to their customers. I plan on closing my account and not doing business with this bank.

Valerie Lewis says

I have read through a lot of your reviews and l need help with a question, l was just offered a CareCredit card which is a healthcare credit card for my dental needs. I would truly appreciate some feedback on this matter. and yes I do have health insurance, but they won’t cover the total cost. Has anyone else dealt with Synchrony Bank with this issue? I need to know before I accept their offer.

Hi Valerie – CareCredit is similar to a credit card but they offer short term financing (a loan) of 6 months all the way to 24 months. There’s no interest if the purchase is for $200+ and when you make the minimum monthly payments. It’s essentially a line of credit for healthcare costs.

The thing to watch for is the rate when the promotion period ends. This is similar to how electronics stores give you “No financing for 24 months!” when you buy a TV. Watch the interest rate when the offer expires and if you can pay it off before the period, awesome, otherwise you’ll owe some (or a lot) interest.

Seymore Clearly says

I see not much has changed with Synchrony, whether it’s banking or credit-related. Their business practices were & still are abusive -if these comments are any indication. Looks like it’s running 50/50 whether a customer is having a good experience or not.

One of these years Synchrony upper management will get a clue: do right by your customers & your business will reap the rewards. Instead of adhering to that one most basic principle, their upper management continue abusing their customers. What gives?

And it is true that Synchrony moved some of their customer service operations to India. Bad move. Perhaps they were trying to achieve better 24/7 coverage, but as I stated to them 2 decades ago: Their bad business practices create more calls, and multiple ones because rarely will customers’ issues be effectively resolved with just one call. You can thank Six Sigma for this.

I should know -i worked for them. As of this date, Synchrony has lost Walmart, and may have lost more strategic retail partners because of their abusive business practices.

Synchrony, when will you learn the most basic business principle: treat your customers as you would wish to be treated? Because I guarantee your customers have or will figure out that this fish stinks from the head down -not the tail up.

John clevenger says

I had a credit card with them that was interest free for six months. I charged $1,600 and paid it off in 4 months. I also made the payments 10 days early each month. Instead of internet, they sat on the payment each month until they could add a late fee of $28 each month. I have not made a late payment on anything in many years. After a lot of phone calls and yelling, I got the late fees removed.. I will never again use them for anything and will advise my friends to stay away from them.

D. Mixon says

Contacted synchrony On three occasions in order to resolve a debt incurred by pressing the wrong PayPal button. I was very disappointed in the fact that I could not understand the person that I was speaking to and basically given the runaround on how to pay the past due based on my mistake. Also, the interest rate charged was outrageous. I will never deal with them again and ensure that when using PayPal but I will not press the credit button by mistake.

Patricia E says

Hello Jim,

I applied for a Sam’s Business Credit Card through you all and was denied because they stated that my tax ID number could not be identified.

After calling and calling and spending roughly about 5 hours on the phone with the fraud department in one of your Sam’s Location, no one could give me a credible answer. I was told to contact Experian and I did and my information was correct.

What happened was I took my application inside of the store and the young lady at the customer service counter stated that she could not find my credit app and that she would have to do another one(even when I had all correct information with me). She incorrectly put in wrong information and the app that she did failed. They spelled my business name with letters instead of using the character that it has. For some reason, you all do not accept characters which I think is a very horrible idea.

When I spoke with people in the fraud and credit review dept all I was getting from them is that I would be getting a letter in the mail and when I did receive the letter it stated that my tax id could not be verified.

That is a kick in the face to me because I am a reputable business owner. I have tried and tried numerous of times to speak withsomeone in the underwriting department but they send me to the credit review dept and I only get that they cannot provide me an information.

Can you please advise as to what type of system you all use to obtain this tax id information? As I have explained to everyone I have spoken to, my tax ID belongs to my business. I can’t help that your reps are providing wrong information. They had the name of my business incorrect, the wrong phone number, everything. They stated that I provided the information to the lady at the Sam’s store and I told them I did not. I had the paper app that I submitted and provided it to the rep. I need answers as to how you all can treat your potential customers this way. I currently have a Lowes and amazon account through Synchrony but for some reason I am being denied for a Sam’s card?

Please advise

Thanks

Hi Patricia – we are not affiliated with Synchrony Bank so you’ll have to reach out to them directly to get your problem solved.

Don Valentine says

Synchrony Bank is little more than a pack of lying thieves charging rates that are in the stratosphere (like 29%), not posting payments until they have held them long enough to stick you with a fraudulent late charge and other such gimmicks to steal your money. They are little more than a legalized Mafia. To make matters worse, when you pay off most of a high credit card balance in one or two payments to avoid as much if their highway robbery interest charges as possible they immediately lower the credit limit they previously gave you to only a few dollars over the remaining balance so they can report to the credit bureaus that you are using nearly the maximum credit they allow under the new and lowered limit as a crooked method to have your credit score reduced. Once that occurs it used as an excuse to charge the highest interest rate they can get away with. God help these criminal bastards if Bernie Sanders becomes the next president. Such crooked “financial institutions” will likely find their doors shuttered for good as they should be. I also now boycott any store for whom Synchrony issues specialized credit cards as well such as TJMaxx and it’s affiliates, eBay and such.

Sheryl Langdon says

I loathe calling customer service when it’s someone who hates their lives and I can literally hear their hate across my phone line. I think technology has ruined everyone. I have worked horrible Customer service jobs and I still upheld pleasant customer service. I don’t have faith in anything automated anymore because of the humans on the other end of the technology. There’s no real time accountability. I don’t want a young unhappy India boy (and I mean boy figuratively) angrily handling my important secured financial information. Move customer service back to my nation in the U.S. for daytime services. I understand for night customer service to send it overseas. But, enough already. I don’t feel safe.