If you’ve been thinking about opening an account with Ally Invest, this review is for you.

I’ve been using Ally Invest as my primary stock brokerage for years. I started with TradeKing, stayed on during the acquisition, and have held a sizable portion of my investments with Ally Invest.

I’m a fan because they offer free trades, a rich suite of research tools, and an interface that is intuitive and easy to navigate. They don’t offer free trades of mutual funds but I invest in mutual funds directly with Vanguard so this isn’t an issue for me. (Ally Invest offers free trades on ETFs though)

Read on to discover this in-depth Ally Invest review.

Table of Contents

🔃 Updated February 2023 to reflect that Ally Invest has removed their $9.95 mutual fund transaction fee.

Who is Ally Invest?

Ally Bank got into the brokerage game through acquisition in 2016 and renamed it Ally Invest Securities, or Ally Invest for short. They’re regulated by FINRA, you can look up their listing on BrokerCheck, and they’re licensed to operate in all 50 states plus Washington D.C. and Puerto Rico.

Ally Invest has self-directed trading accounts (taxable brokerage, IRA) as well as “Robo Portfolios,” which is their term for their robo-advisory-like automated investing services. We will dig more into both of those account types.

Self-Directed Trading Accounts

Ally Invest supports taxable brokerage accounts as well as individual retirement accounts with no minimum. You can trade practically everything – stocks, bonds, mutual funds, ETFs, options, and even forex. The only asset not on that list is cryptocurrencies but I don’t invest in cryptocurrencies – and here’s why.

Best of all, all those trades are commission-free. Options have a $0.50 per contract fee but no base commission is charged.

The platform is pretty sophisticated and offers everything you could need from your basic brokerage account. There are real-time quotes, research, a customizable dashboard, and it is all accessible online. You don’t get Level 2 market data though.

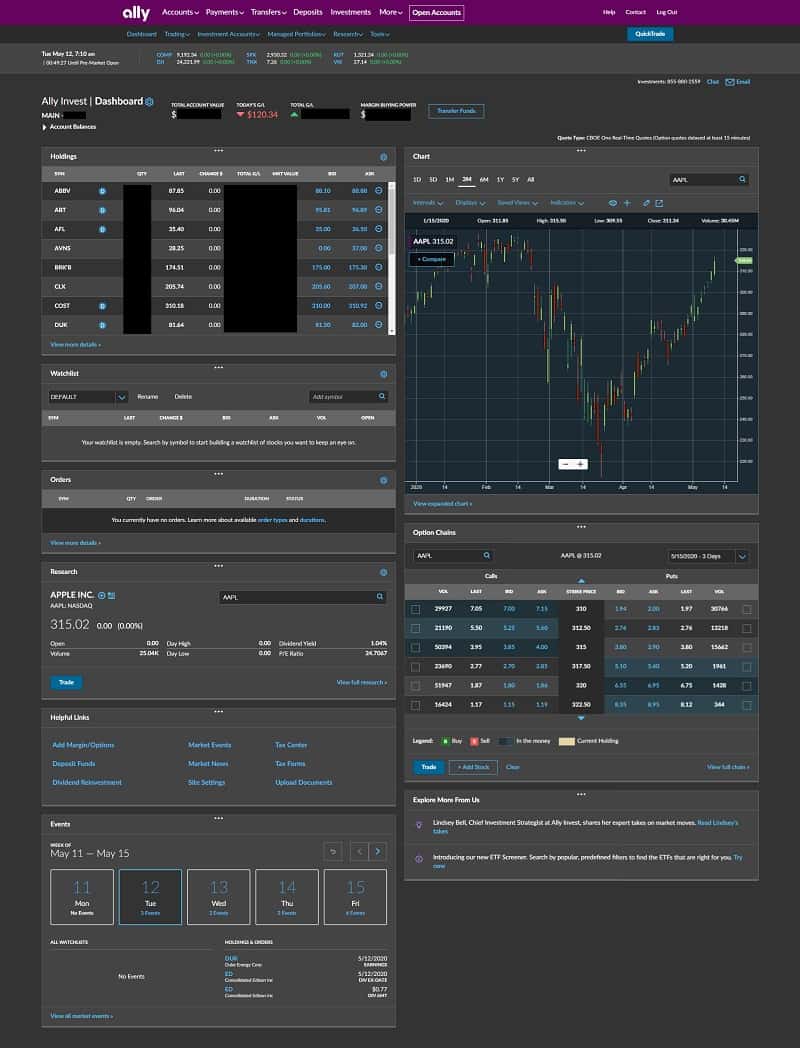

Here’s a shot of the top of the default dashboard (they call it Ally Invest Live, click to expand):

You can customize it but the default shows you a lot of data very quickly, with threads you can pull for additional research. The best way to use this is as a snapshot into your account to see how your portfolio is performing.

The Dashboard is very well designed and intuitive to use. When you click on a stock in your Holdings, all the other panels update to that stock – the Chart automatically updates to show you the trailing three months, Options Chains updates to show you all the call and put contracts (the option chains), etc. You don’t have to enter it manually each time into each panel. When you enter a ticker into the search box within any panel, it updates every other panel too. That’s smart.

For customization, you can change what’s shown within each panel. You can also move the panels around but you can’t add or remove panels – though I’m not sure if there is a panel that I’d add that isn’t already here.

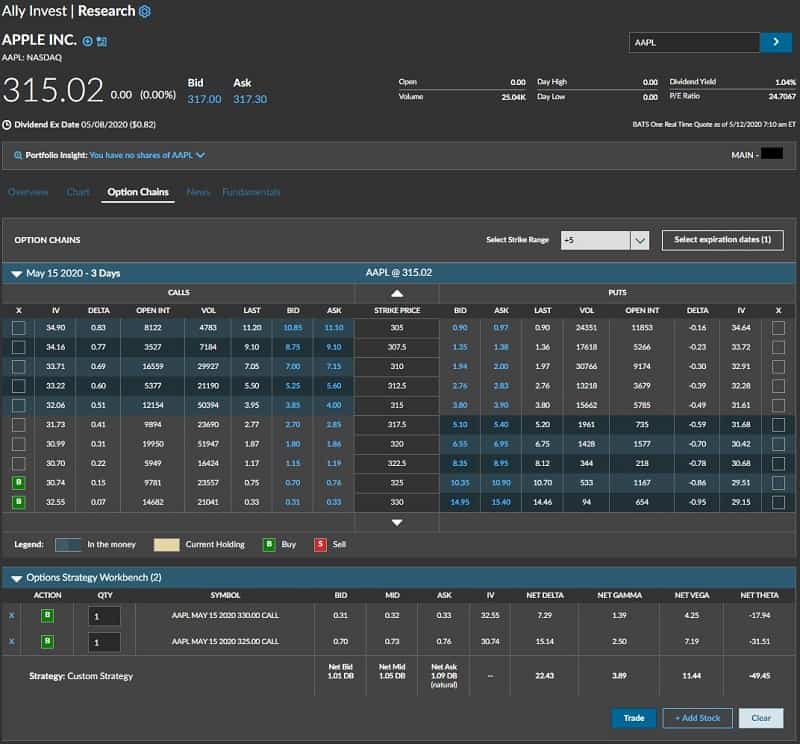

Within the Option Chains panel, you can dive into the chain of a stock and build an options strategy using their workbench (here I am buying out of the money calls on AAPL):

Ally Invest has good options forecasting and pricing tools because TradeKing catered to options traders (more volume meant more commissions, a smart business strategy!). As a result, Ally Invest now has great options trading tools.

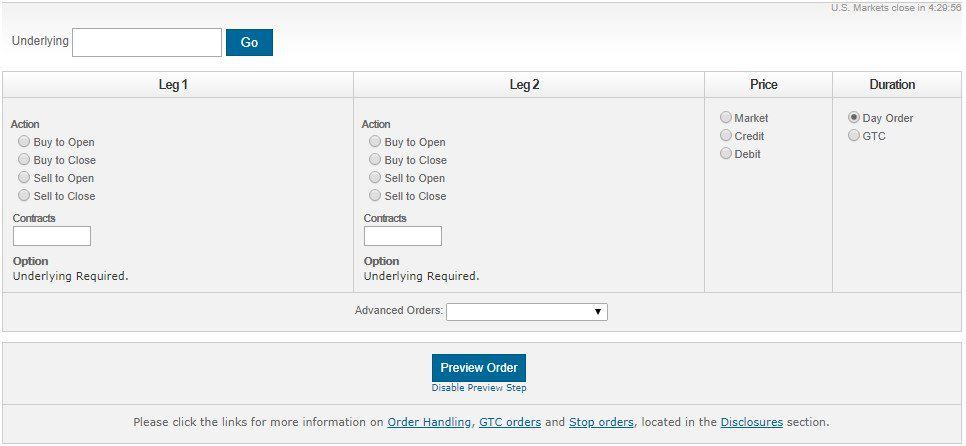

If you don’t want to use Ally Invest Live, the legacy platform still exists and makes it easy to build more positions.

Want to write a straddle? Here’s the screen you use to enter it:

Fee Structure

The fee structure on the self-direct account is pretty much as low as you can get:

- $0 commission-free trades on stocks, mutual funds, options, and ETFs. Options have a $0.50 per contract fee.

- $0 account minimum

- No inactivity fee

- $50 ACAT fee

Personally, if you want to trade mutual funds, the best way to do that is to open an account with the company that offers the funds. For example, if you want a Vanguard fund, open a Vanguard account because you can buy and sell shares for free. And if you want a Vanguard ETF, you can buy and sell those for free on Ally Invest or Vanguard.

Mobile App

Ally Invest’s mobile app has all the features you’d expect in a brokerage’s mobile app – including the ability to complete any transaction on the app that you’d be able to do on the website. I don’t use the mobile app because I don’t like making major money decisions (like buying and selling shares of stock) on my phone. I prefer to sit at a desk, look at a computer screen, and “get into work mode.”

It’s a little harder to do research on the phone as the only place where “news” is pulled into the app is on the research page and the only source appears to be from MT Newswires.

But if there was some kind of emergency or urgent need, I could do it.

Ally Invest Robo Portfolios

With a minimum of $100, you can get a cash-enhanced portfolio with practically no fees – no advisory fees, no annual fees, and no rebalancing fees. They do this because they set 30% of your portfolio into cash, earning a rate of interest comparable to their online savings account. Charles Schwab Intelligent Portfolios operates this way too – no fee but you have to put a set percentage of your allocation into cash. The upside of the cash allocation at Ally is that it’s close to the prevailing rate you’d get with a savings account though you can’t get access it as easily as you would a savings account.

If you want to avoid the cash allocation, you can get a “market-focused” Robo Portfolio but it also comes with a 0.30% annual advisory fee, charged monthly. With market-focused, you still have cash (roughly 2% of your balance) but much much less of it. 0.30% is similar to what other robo-advisors charge – for example, Vanguard’s Personal Advisor Service charges 0.30% on assets up to $5 million.

With Robo Portfolios, you answer some questions about your goals, they’ll build a mix of ETFs that meet your goals, and then you can tweak it as you wish.

Additionally, you can pick from four portfolio options:

- Core: “Highly diversified across domestic, international, and fixed-income assets. You can choose the amount of risk you are comfortable with, from conservative to aggressive. If you’re more of a hands-off investor, consider this portfolio type.”

- Income: “This portfolio type offers higher dividend yields while maintaining a more conservative risk profile. Consider this portfolio type if you’re most focused on yield and income.”

- Tax-Optimized: “If you make after-tax contributions to an investment account, this type of IRA may help maximize your investments. If you’re looking to invest using a diverse mix of tax-advantaged, low-cost Exchange Traded Funds, consider this portfolio type.”

- Socially Responsible: “Shaped by companies with ethical track records, you’ll only invest in businesses that actively practice sustainability, energy efficiency, or other environmentally friendly initiatives. Consider this portfolio type if eco-friendly practices are important to you.”

Then, their systems (and people) monitor your portfolio and rebalance as needed. It’s similar to the robo-advisory services of other companies (in theory).

Learn more about Ally Invest Robo Portfolios

Integration with Ally Bank

They are both under the same branding but the two systems still feel a little separate because they’re still separate entities. When you log into Ally.com to visit your banking, you can see your Ally Invest information.

If you want to take action in your brokerage account, you are transferred to investor.tradeking.com. This means that if you want to transfer money back and forth between, say, your checking account and your brokerage account – there’s a delay depending on the accounts in question:

- To and from Ally Bank to self-directed accounts: 1-2 minutes

- From Robo Portfolios to Ally bank accounts: up to 5 business days

- Ally self-directed accounts to other institutions: up to 3 business days

- From other institutions to any Ally Invest account: up to 3 business days

Ally Invest Alternatives

Ally Invest has carved out a nice spot as a discount brokerage that does everything well, but how does it compare with some others?

Ally Invest vs. Robinhood

Robinhood’s claim to fame was a slick mobile application with free trades. While not every other brokerage has a great mobile experience, many of them have matched them where it counts the most – free trades. Ally Invest offers free trades too and Ally Invest’s mobile app does everything Robinhood’s app does but it just doesn’t look as slick.

But when it comes to tools, Robinhood doesn’t have the analysis tools that Ally Invest offers. While they give you access to the same tradable securities, Ally Invest’s options tools far exceed those offered by Robinhood. Robinhood doesn’t have the breadth and depth of research either – they keep costs low so they’ve opted not to offer any research from other firms. You can still get publicly available news, conference calls, etc. – but anything extra is unavailable.

The area where Robinhood beats Ally Invest is in cryptocurrency – Ally Invest doesn’t offer cryptocurrencies and Robinhood Crypto lets you trade several cryptocurrencies for free. If fractional shares are important to you, Robinhood has that too whereas Ally Invest doesn’t. Robinhood’s new account promotion is a free share of stock without a deposit requirement, Ally Invest offers cash but you have to transfer in funds.

In the realm of tradeable securities, they both offer stocks, ETFs, and options. Ally Invest offers bonds and forex but Robinhood doesn’t.

Bottom line is that Ally Invest offers everything Robinhood does (except crypto and fractional shares) plus you can tack on a solid online banking experience all in one spot.

Here’s my full Robinhood review.

Ally Invest vs. ETrade

ETrade and Ally Invest are very similar in that they’ve been competing in the discount broker category for ages.

While they’re very similar, ETrade’s big differentiator is that it lets you create paper trading portfolios to help you dip your toe into investing. With a wealth of educational tools, you can study stocks and use their portfolios to see how you’re doing with a “practice” account.

ETrade has a $500 account minimum on their brokerage accounts band while trades of options are free, there is a $0.65 per contract fee at ETrade ($0.50 at Ally Invest).

Related: Best Stock Brokers that Offer Free Trades

Pros & Cons

Like any service, there are things we like and things we don’t.

Pros:

- Ally Invest offers both self-directed brokerage and robo portfolios, like a robo-advisor.

- Low minimum ($100) on Robo Portfolios

- Commission-free trades on stocks, options, ETF, and options ($0.50 per contract)

- No account minimums, no maintenance fees

- Very generous brokerage transfer bonus

- Incoming ACAT fee reimbursement up to $75

Cons:

- Robo Portfolios is free but requires a 30% cash position or you can pay 0.30% per year

- No detailed Level 2 market level data

Final Verdict

Ally Invest is a great all-around brokerage account because of its $0 minimum and commission-free trades on stocks, options, and ETFs. I’ve been using them for years and have never had any issues. With no minimum, association with a great bank in Ally Bank, it’s a good place for any investor looking to start investing.

I first fell in love with them because they offered inexpensive trades but now that so many brokerages are offering free trades, I’ve stayed for the ease and simplicity of the platform.

Ally Invest is best for beginner to intermediate investors who are comfortable managing a self-directed investment account. The low minimums and free trades make it very accessible to someone who doesn’t have a lot to invest but the tools and features of the account still support someone who needs more.

If you just want mutual funds, skip Ally Invest – go with the company offering the funds directly. If that’s Vanguard, open a Vanguard account. If it’s Fidelity, open a Fidelity account.

If you want a hands-off managed fund like a robo-advisor, Ally Invest offers a pretty good product but compare it with the leading robo-advisors currently available.

It’s not ideal for advanced investors, day traders, technical traders, or someone who needs a lot of market data (Level 2) to make decisions. If that describes you, there are other brokerages that will give you that level of detail into the market.

Brian Thomas says

Comprehensive and helpful review, thanks for this!

You’re welcome!

Christina F says

My 18 year old son, whom will be going to boot camp for the Marines later in the year, wants to invest some of his funds to grow. Should we start with a CD or something through our credit union?He is on his phone often (though no phones at boot camp) maybe an investment company with a great mobile interface? I would say he would start with either $100-$500, I guess he could do automatically drafts from his account. He currently does work and will be paid in boot camp. Opinions? Options? Suggestions?

A CD or a savings account isn’t really an “investment,” they’re just to save money and have it grow a little bit. With a smaller sum, it might be fine but if you want to build wealth you’ll need to look into the stock market. He may do well to start putting a little bit into an index fund to start off if he’s OK with not touching it for 5+ years.

SuperSaver Mom says

Hi, I have a some money in the bank with 1% interest. My husband likes to play around with stocks and so he manage that part of our finances and I manage the savings. But I feel like our savings can earn a little bit more without getting too risky. What do you suggest.

I’m afraid the interest rates on savings are pretty low right now with the Fed keeping the federal funds rate so low. Not many options and they’re all similar in terms of rates.

Marvin Adelglass says

The biggest problem with Ally when it comes to the purchase of T-Bills is the charges. If you purchase a bill for $250,000.00 the charge is $250.00 which is outrageous. E-Trade, Fidelity, TD Amertrade will purchase a T-Bill and Certificate of Deposits without any commission. I am surprised that you did not mention this rip off.

I never mentioned it because I never bought T-Bills so I didn’t know what their fees are on that. Why not buy them through Treasury Direct?

Al G says

The only thing that is making me question Ally Invest over Robinhood is that I cannot get an historical account value on Ally Invest. On Robinhood, I can see what the account value was at a certain date. Ally Invest even confirmed this simple functionality is absent from their platform. Seems silly.

Rod Roark says

I’ve used Ally Bank for years and just started with Ally Invest in January. A couple of annoying software glitches mar an otherwise good experience:

1. Dividends are slow to post in account activity.

2. I turned on the option for automatic reinvestment of dividends, but found that the fractional shares do not liquidate (at least not promptly) as promised when selling all of the whole shares.

3. I turned OFF the option for automatic reinvestment of dividends but it was ignored; weeks later dividends continue to be reinvested.

4. Twice I have received emails from them saying my quotes will be delayed because they don’t have sufficient evidence that I’m not a market professional and that I must contact them to “reset” some form that I have to fill in again. This is ridiculous.

Those seem like a pain to have to deal with – none on their own are deal breakers but when you have to keep going back to it then I can see it get really frustrating.